how much does the uk raise in taxes

Government revenue comes from taxes. Without this fuel tax petrol and diesel would be quite cheap.

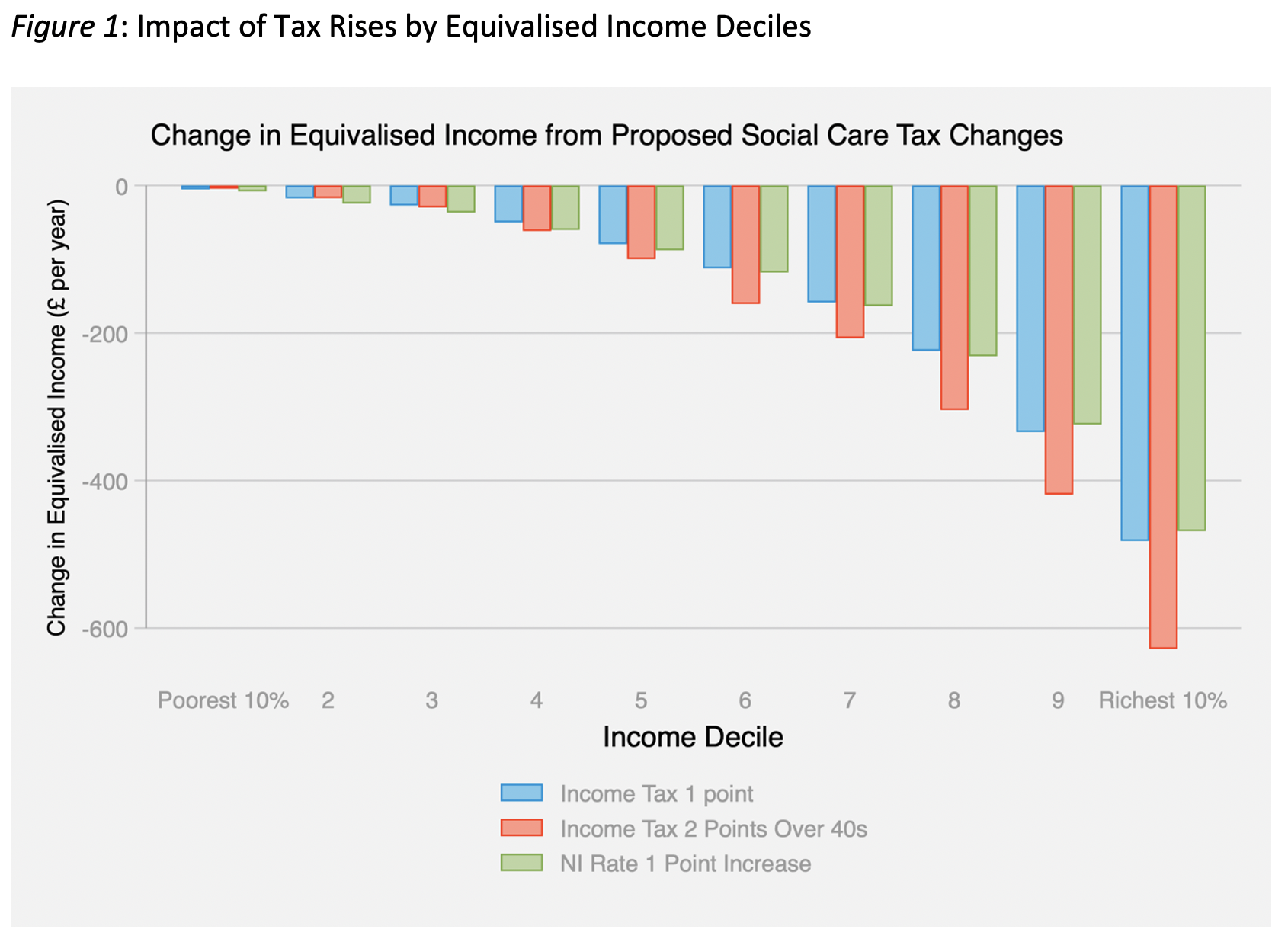

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

What is the tax increase for.

. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. The dividend ordinary rate will be set at 875.

You do not get a. Alongside the levy which will be paid by employees the self-employed and businesses the government has announced a 125 increase in dividend tax rates from 1 April 2022 taking rates to. Over 820 billion is raised annually from taxes social security contributions and other sources by the UK government equivalent to around 37 of its GDP based on its estimates.

Any such change would break the Conservatives. But receive over 5000 in tax credits and benefits. Overall the average household pays 12000 in tax and receives 5000 in benefits.

In line with the 6 percent CT rate increase the rate of Diverted Profits Tax will also increase by 6 percent to 31 percent from April 2023. 875 for basic rate taxpayers 3375 for higher rate taxpayers and 3935 for additional rate taxpayers. However inequality in the UK has increased since 1980.

There are three main sources of funding. The earliest records held at the Institute of Fiscal Studies are for the tax year 197879 when the UK Government raised 49billion in VAT. - in 201112 Scotland contributed 569 billion in tax revenue which is equivalent to 10700 per person compared to 9000 per person for the UK as a whole- since 198081 Scotland has contributed 222 billion more in tax revenues than if it had just matched the per capita contributions of the UK.

How much money does Scotland contribute to the UK in taxes. Income tax National Insurance contributions NICs and value added tax VAT. Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1.

A 1 tax on the use of the policy would be raised by Labour the party claimed. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person. How much does the UK raise in tax compared to other countries.

For comparison that sum would be worth 245billion today based on historic inflation. If a tax of 2 billion a year were used for national health service then each owner of an estimated 100000 homes valued at over 2 million would have to pay 1012 pounds a year. That would be an extra 91000 in tax revenue per person.

You can also see the rates and bands without the Personal Allowance. UK tax revenues were equivalent to 33 of GDP in 2019. Uk Tax Revenue 2019 Statista The Top Rate Of Income Tax British Politics And Policy At Lse The Pay Raise Is Just Large Enough To Increase Your Taxes And Just Small Enough To Have No Effect On Your Take Home Pay Humor Quote Posters Fun At Work.

The original 125 percentage point increase in National Insurance was supposed to raise 12bn a year. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019. A large chunk of what UK drivers pay for fuel goes directly to the government.

How much does the uk raise in taxes Monday February 21 2022 Edit. According to the 20182019 Government Expenditure and Revenue in Scotland GERS report tax revenue in north of the border amounted to. This represented a net increase of.

Mr Sunak described the measures as a 6 billion personal tax cut for 30 million people in the UK stating that 70 per cent of workers would pay less tax even after the. In 202021 the value of HMRC tax receipts for the United Kingdom amounted to approximately 556 billion British pounds. Official UK figures show that in the first week of October 2020 the average price of unleaded petrol in the UK was 11326p per litre.

Increases added to the rate applied from 9568-50270 of earnings 12 and to the rate charged on earnings above that 2 It will be extended at that point to cover pensioners who are. They receive around 2000 in benefits. This represented 7 of the governments total revenue in that year.

The increase is projected to bring in additional revenues of 119 billion in 2023-24 rising to 172 billion in 2025-26. How much does fuel really cost. Total tax receipts in 201718 are forecast to be 690 billion.

Johnson said the 20 basic rate of income tax could be increased by two or three percentage points and that the 40 higher rate could also go up. The richest 10 pay over 30000 in tax mostly direct income tax. 2 days agoHow Much Would A Mansion Tax Raise Uk.

This measure increases the rates of Income Tax applicable to dividend income by 125.

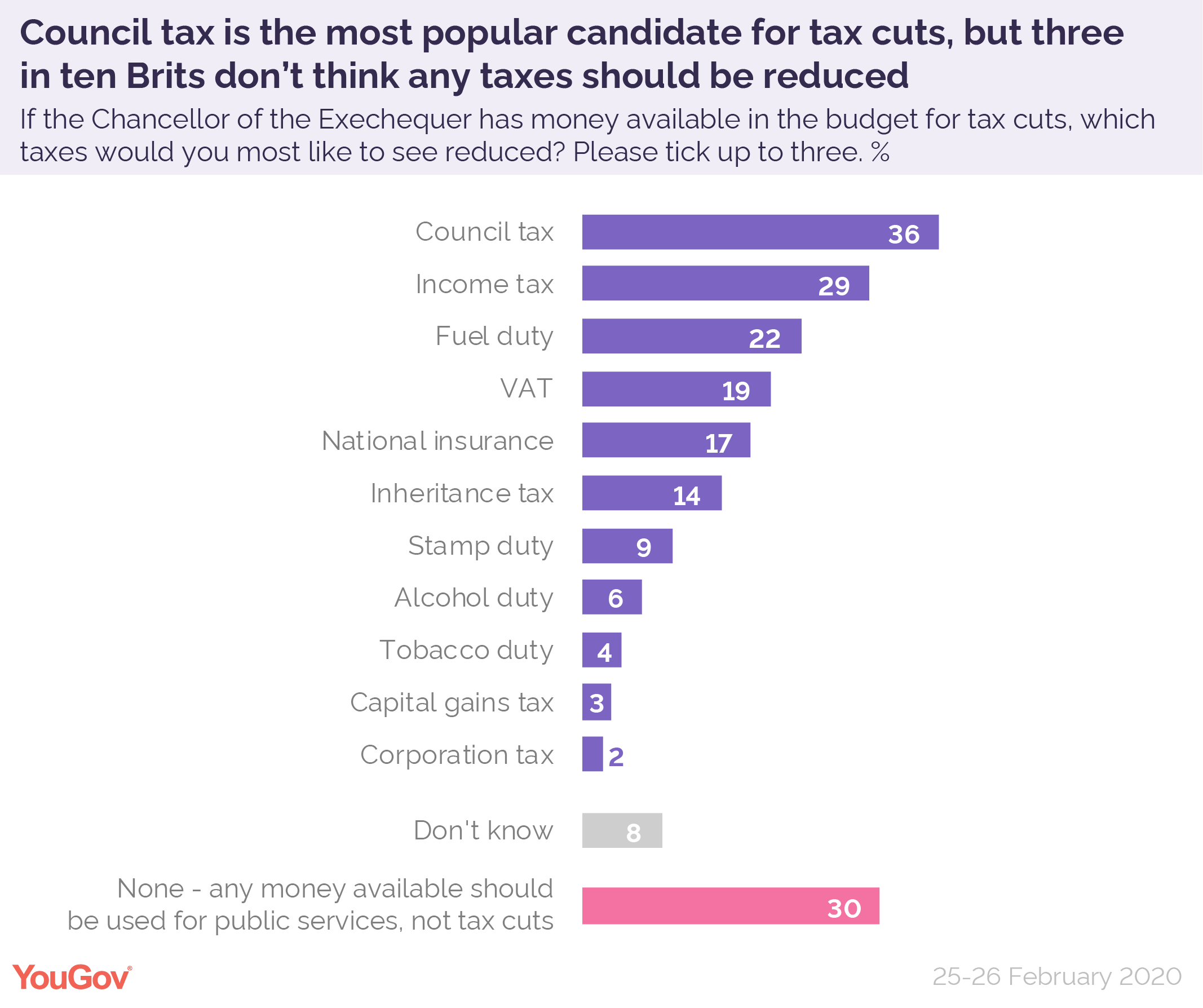

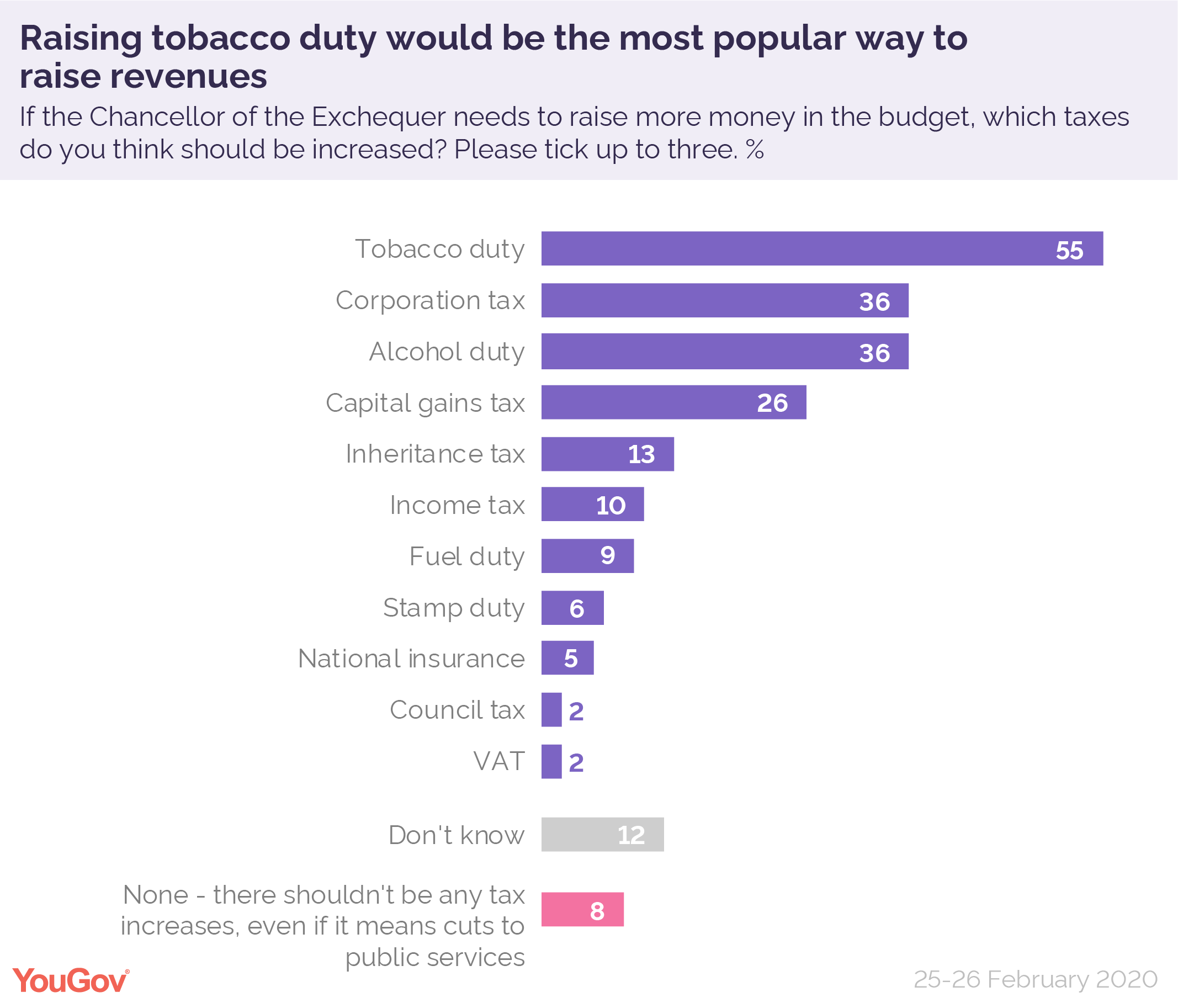

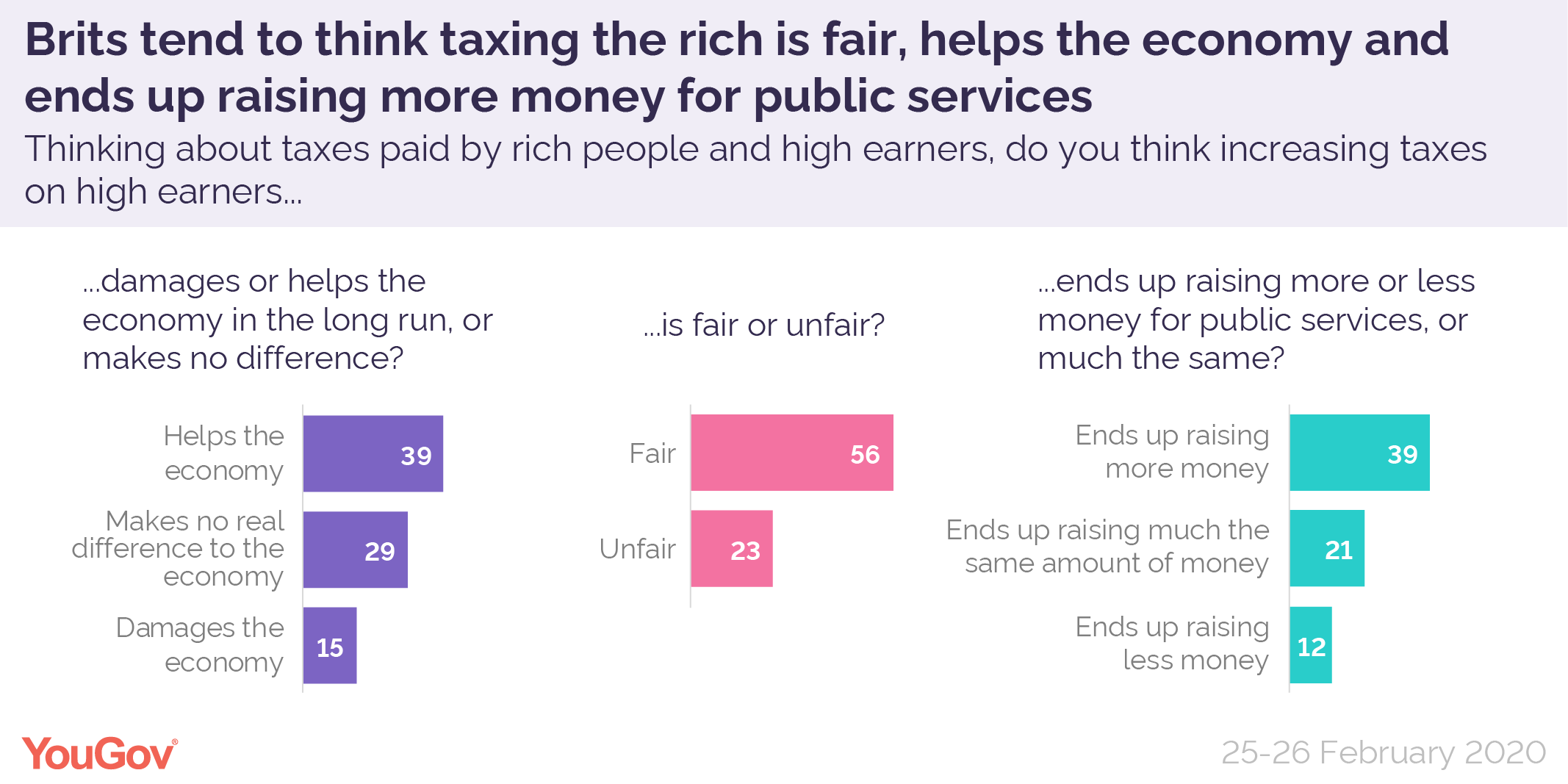

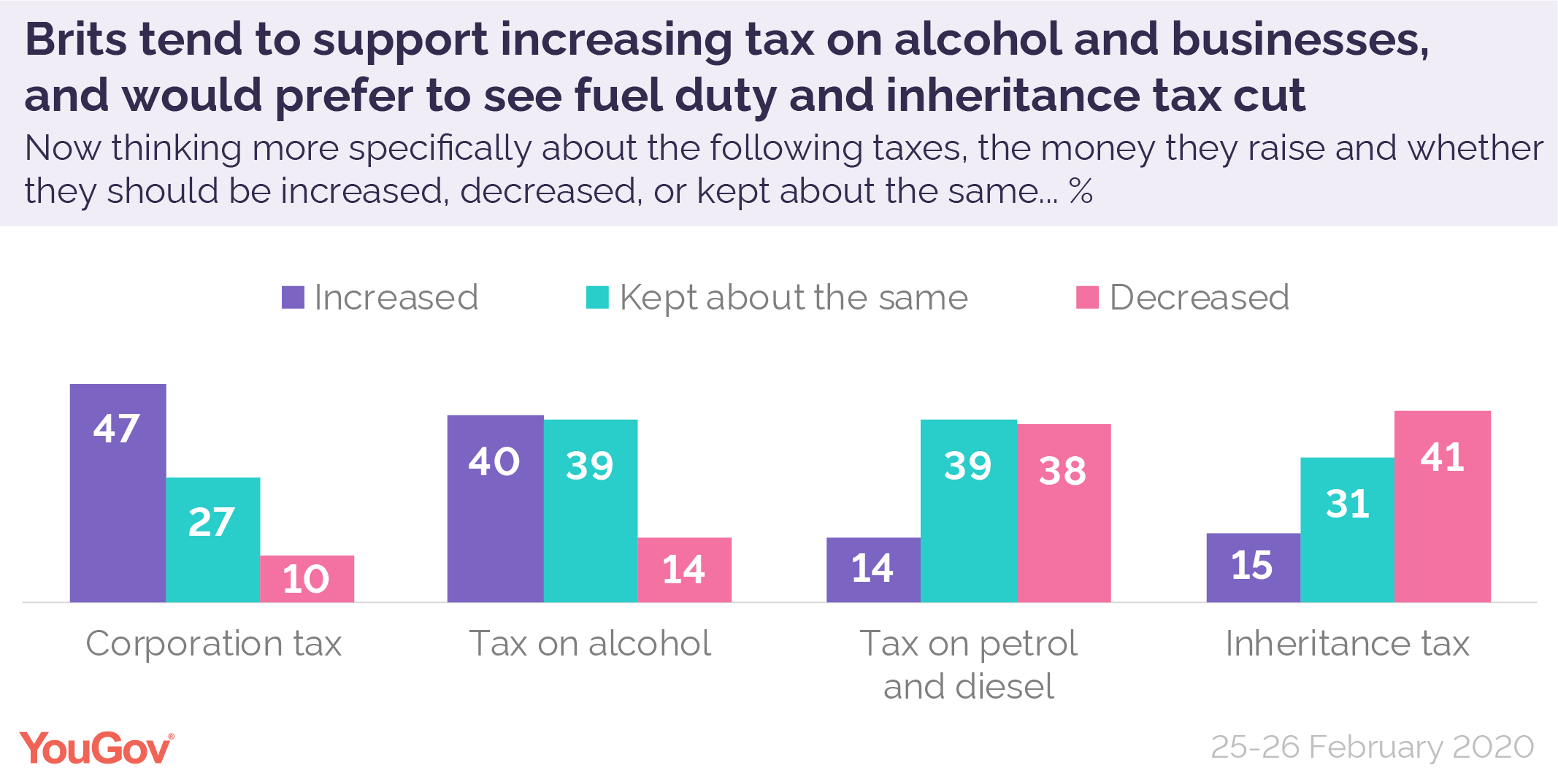

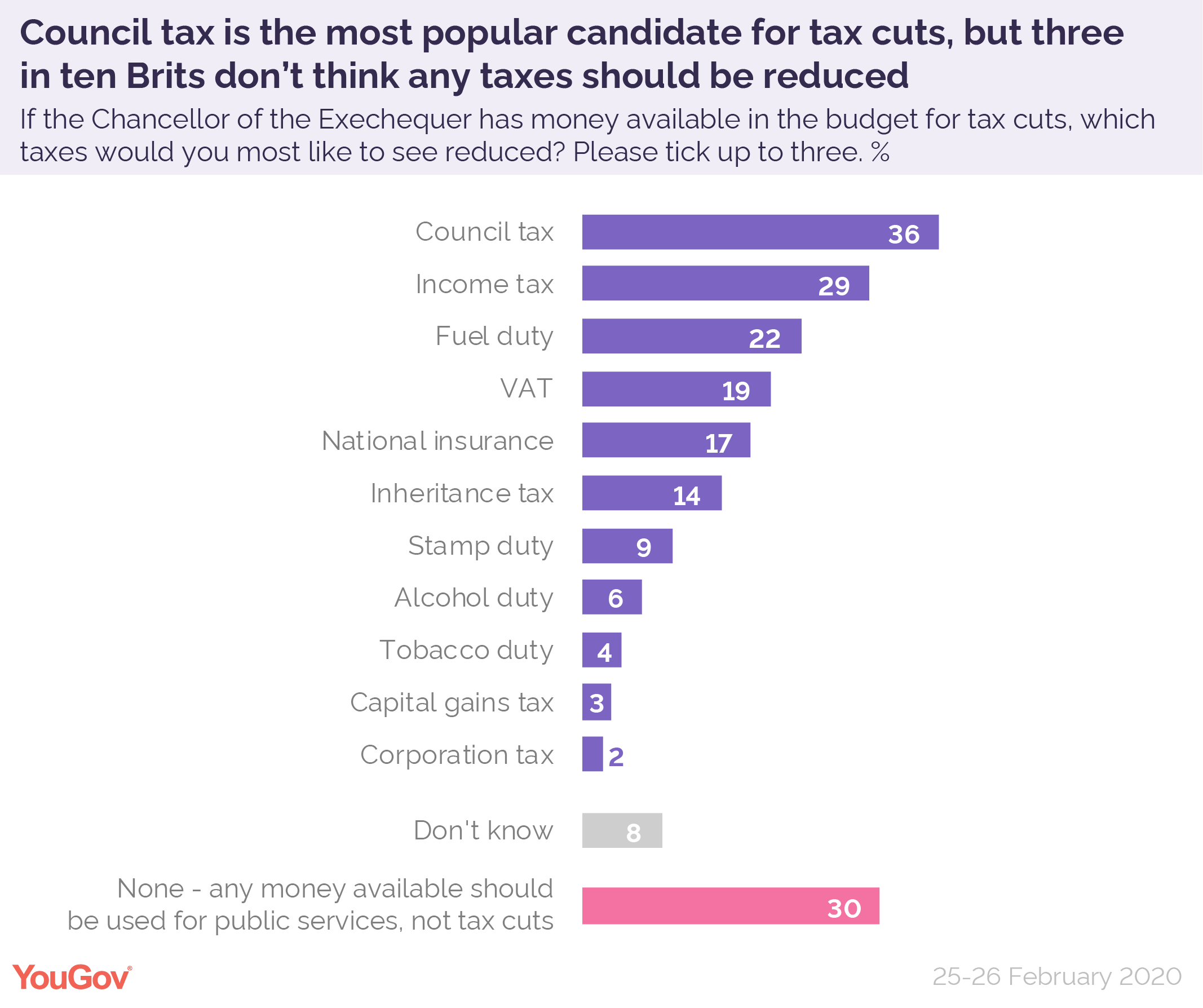

Budget 2020 What Tax Changes Would Be Popular Yougov

How To Raise A Proper British Child In 20 Steps Taxes Humor Accounting Humor Funny Quotes

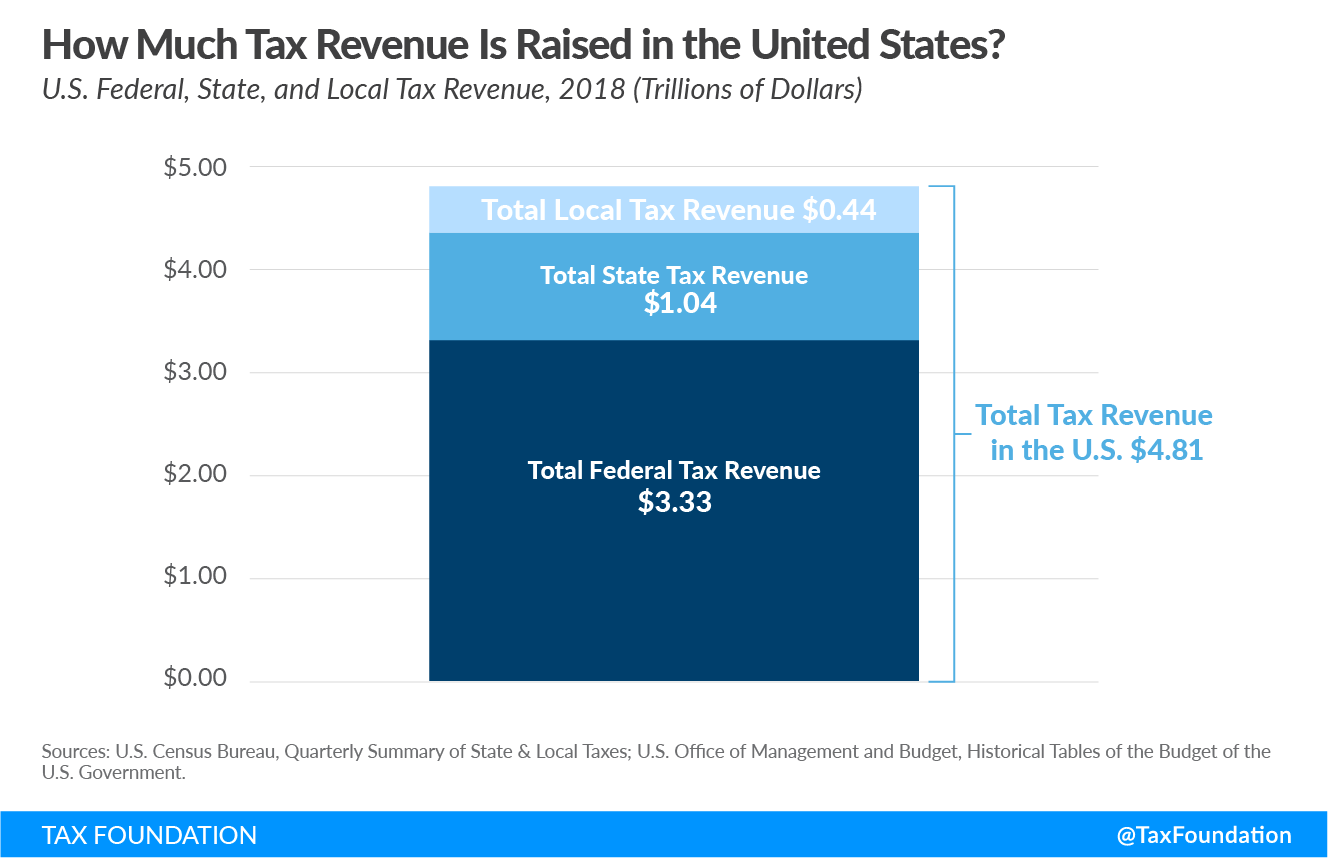

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Government Revenue Taxes Are The Price We Pay For Government

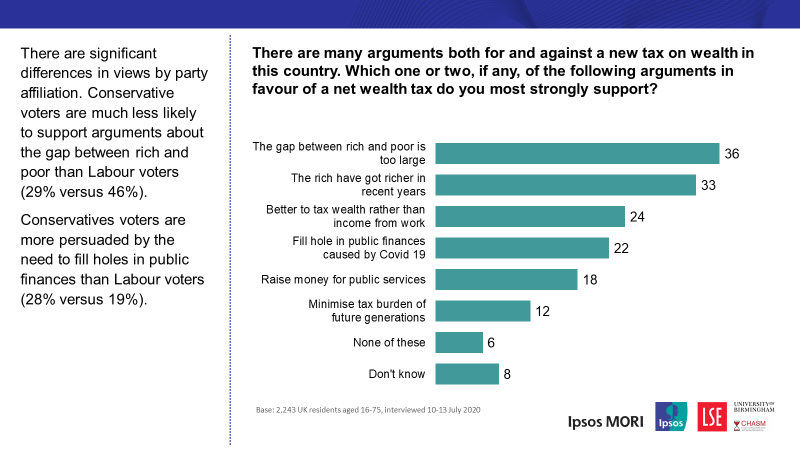

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Trump Republican S New Corporate Taxscam The Inescapable Conclusion Of A New Itep Report Assessing The Taxpa Skills Professional Business Cards Foil Stamping

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Budget 2020 What Tax Changes Would Be Popular Yougov

Budget 2020 What Tax Changes Would Be Popular Yougov

Raise Our Taxes Obama Quote Power To The People Tax

Types Of Tax In Uk Economics Help

Budget 2020 What Tax Changes Would Be Popular Yougov

How Do Taxes Affect Income Inequality Tax Policy Center

Government Revenue Taxes Are The Price We Pay For Government

Government Revenue Taxes Are The Price We Pay For Government

Pin On The Truth Will Set You Free

Following The Biggest Gap Between Budgets Since Before 1900 New Chancellor Rishi Sunak Will Prese Social Worker Resources Economic Research Economic Analysis

Pardon Our Interruption How To Raise Money Tax Tax Preparation

Are Britain S High Earners Taxed Too Much Or Too Little Tax The Guardian